How to Send and Store your Bitcoin (and other Cryptocurrencies)

Originally published in the New York Observer

Recently, some poor schlub in an Ethereum Facebook group posted that he lost $4,000 worth of ETH when he mistakenly sent it to the wrong wallet. Apparently, he typed the address (never type the address) and mistyped one letter sending the cryptocurrency to a wallet not his own.

Instantly, the thread blew up with comments like, “you typed???? Never type your wallet address!” or “Sorry buddy, that money is gone” or “don’t worry, you’ll get it back as soon as the blockchain realizes it’s not a valid address” and a retort “No, you’ll never get it back”.

400+ comments later and someone from the Ethereum foundation itself broke the bad news that indeed the ETH was gone forever. Had our hero typed something like “cottoncandy” the blockchain would have bounced the transaction since the string of letters do not conform to ETH wallet address mandated format.

But because he typed, and was only off by one letter, the transaction was validated and confirmed. It is written into the Ethereum code that every possible address exists within the set character and length parameters, waiting to be claimed. But if ETH is transferred into an unclaimed address there is no way for anyone to access the private keys, so that money is gone. Forever. For everyone.

On that note, here are some tips to avoid losing cryptocurrency during moves, and a few best practices for storing the coins you own:

MOVING CRYPTOCURRENCY

🚨 Never type the address, human error is too easy, and the consequences too dire.

The two best methods for non-technical people sending and receiving cryptocurrency are copy/paste and the QR code.

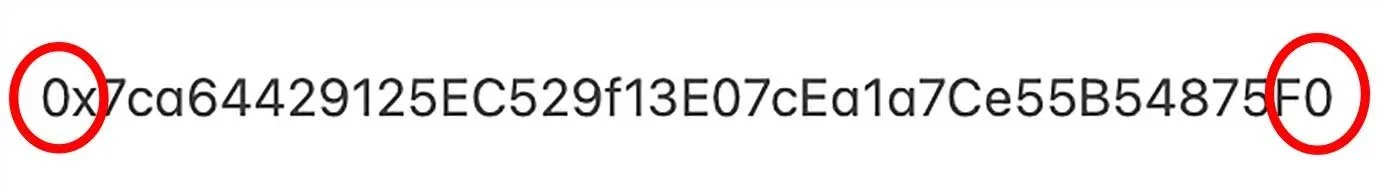

Copy/paste is very safe, just be sure to triple check before hitting ‘send’ by confirming the first and last letters are correct (everything in between will be fine-but still check - scammers are getting more sophisticated).

The QR code requires a simple scan and confirm (also comes with some risks of being malicious so be sure the code is from a source you trust.

STORING CRYPTOCURRENCY

3rd Party Exchanges

Exchanges are the most convenient, but the riskiest places to store your cryptocurrency. Last week, we mentioned the Mt Gox and Bitfinex hacks which lost its users over 970,000 BTC ($12 billion) none of which has ever been recovered.

Exchanges are not banks.

Here are a few of the most widely used cryptocurrency exchanges:

Coinbase is by far the easiest of all of the 3rd party exchanges. All the main cryptos can be bought and stored there (BTC, ETH, SOL, DOGE, etc). Drawbacks: they do not support all altcoins and memes.

Other exchanges include Binance, Gemini, Kraken and many more popping up all the time.

Most 3rd party exchanges are free to store cryptocurrency, but transaction fees of around 0.25% are common. Also, deposit and withdrawal fees are low and varied.

Decentralized Wallets

Metamask is industry standard, especially for Ethereum. You use it with a browser extension and/or an app on your mobile device. Each wallet comes with it’s own address depending on the blockchain you are using, ie: ETH, Polygon, AVAX, Linea, etc. More are added regularly. On Metamask you can store and swap most cryptocurrencies. You can also connect it to other decentralized exchanges to make swaps there if you want to shop around for better fees. Occasionally, Metamask won't have the coin you are looking for so you will have to connect it to an outside exchange. Always be careful when connecting your wallet to any outside exchange.

Exodus.io is a decentralized application that is installed on a desktop. Users are anonymous to the company except for an email address given at sign-up in case an account is lost. It is a gorgeous, elegant user experience that displays the portfolio visually and hosts 18 of the most popular coins. Drawbacks: the private keys are stored on the user’s hard-drive, which is connected to the Internet leaving it vulnerable to hacks. It only supports 18 of the over 1,400 cryptocurrency coins.

Hardware Wallet

Industry standard for crypto pros. Hardware wallets allow you to move your cryptocurrency off of the Internet and out of the hackers reach. Some of the top hardware wallets include Ledger and Trezor. Drawbacks: a clunky user experience — if you want to put the breaks on impulsive day trading this is the way to go since it takes several steps to move crypto back to the exchange. Also, there is currently no hardware wallet that supports all coins.Paper Wallet

Just like it sounds, this is a piece of paper on which the user’s private keys are printed. In terms of computer hacking, it is immune. The paper should be stored somewhere safe, for example a safe deposit box, since it is basically cash and if you lose access to the numbers you lose access to your crypto.Brain

Folks with great memories can literally cross borders with billions of dollars, to the chagrin of international customs and border patrols around the world. Not the most practical way to store Bitcoin, but certainly the most personal.

Conclusion

Many of today’s crypto pioneers are regular folks standing on a paradigm crushing fault line. One foot is planted safely in the FDIC protected banking world with all its security rich UX, and one foot is in the open scab of the blockchain where the only protection between them and complete financial annihilation are confusing exchanges, clunky wallets or a string of characters too long to memorize.

Unfortunately, we might lose a few.

So be careful. Bitcoin has given us the power to fully managing our own money, and with that power comes huge risk. Until the products catch up we all have to beware.